CASH OFFER

A self-service remittance offering that stands out in a crowded market with data secured through personal phones and coin kiosks reimagined as cash drop off ATMs.

01 ► Refresh Your "Senses"

02 ▼ Opportunity

With $700B sent in remittances per year and 1B people sending or receiving everyday, the crowded market of remittance services provide complicated, multi-step procedures with excessive overcharging of rates.

Designing the remittance ordering to be performed on customers' analog phones (SMS remote system) or a smartphone, provides processing security for sensitive data and guarantees low rates without asking customers to change their personal routines and habits.

03 ► Features

Retail services offer desirable in-person clerks, but also insecure data collection, limited business hours and unpredictable high fees. Digital-only services lower those fees but limit cash-out options, require being banked, and a high level of digital savvy. Leveraging trusted phones already in customers' pockets to access a hybrid remittance service delivers users convenient control, transparent safety + playful motivation.

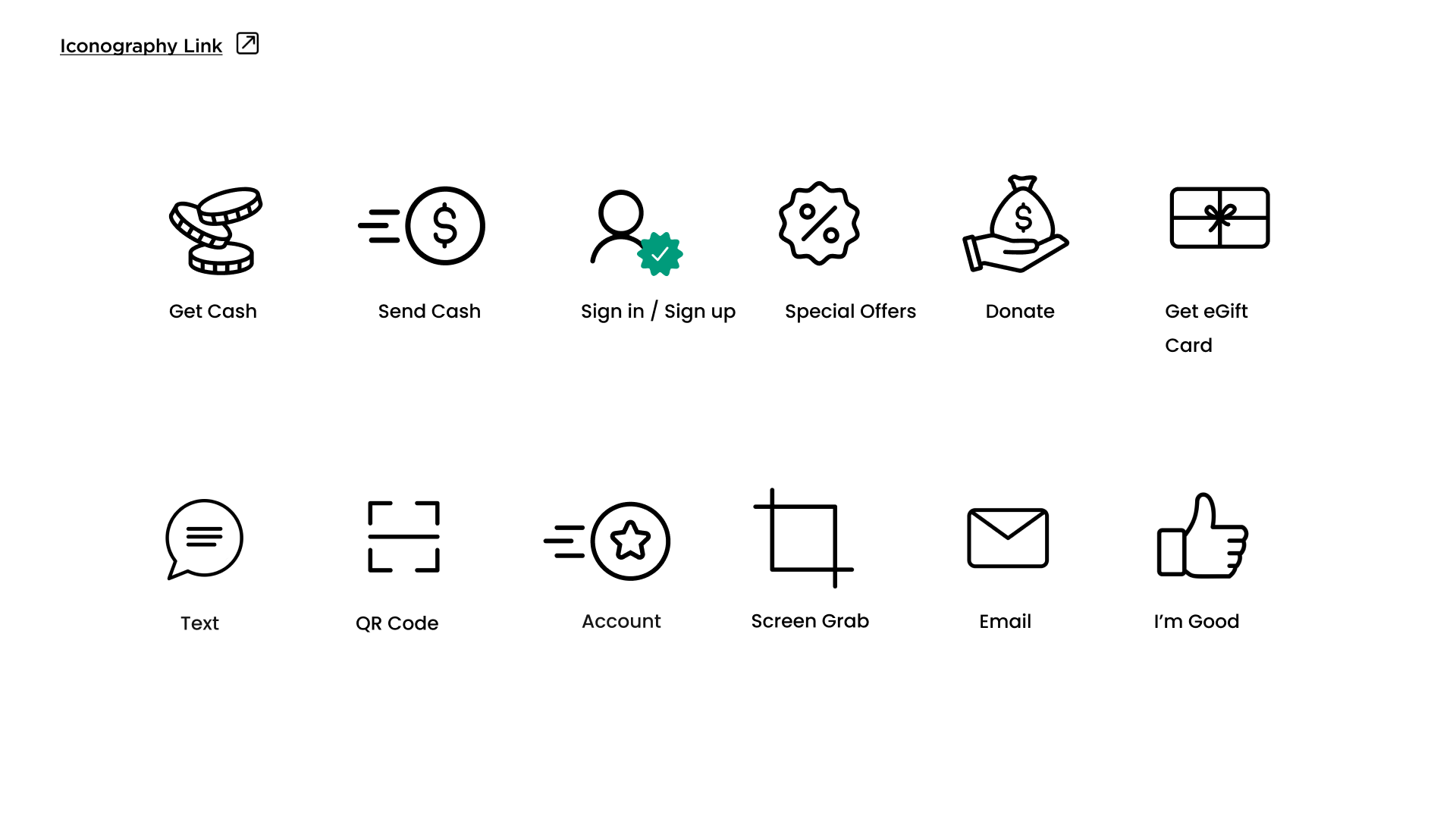

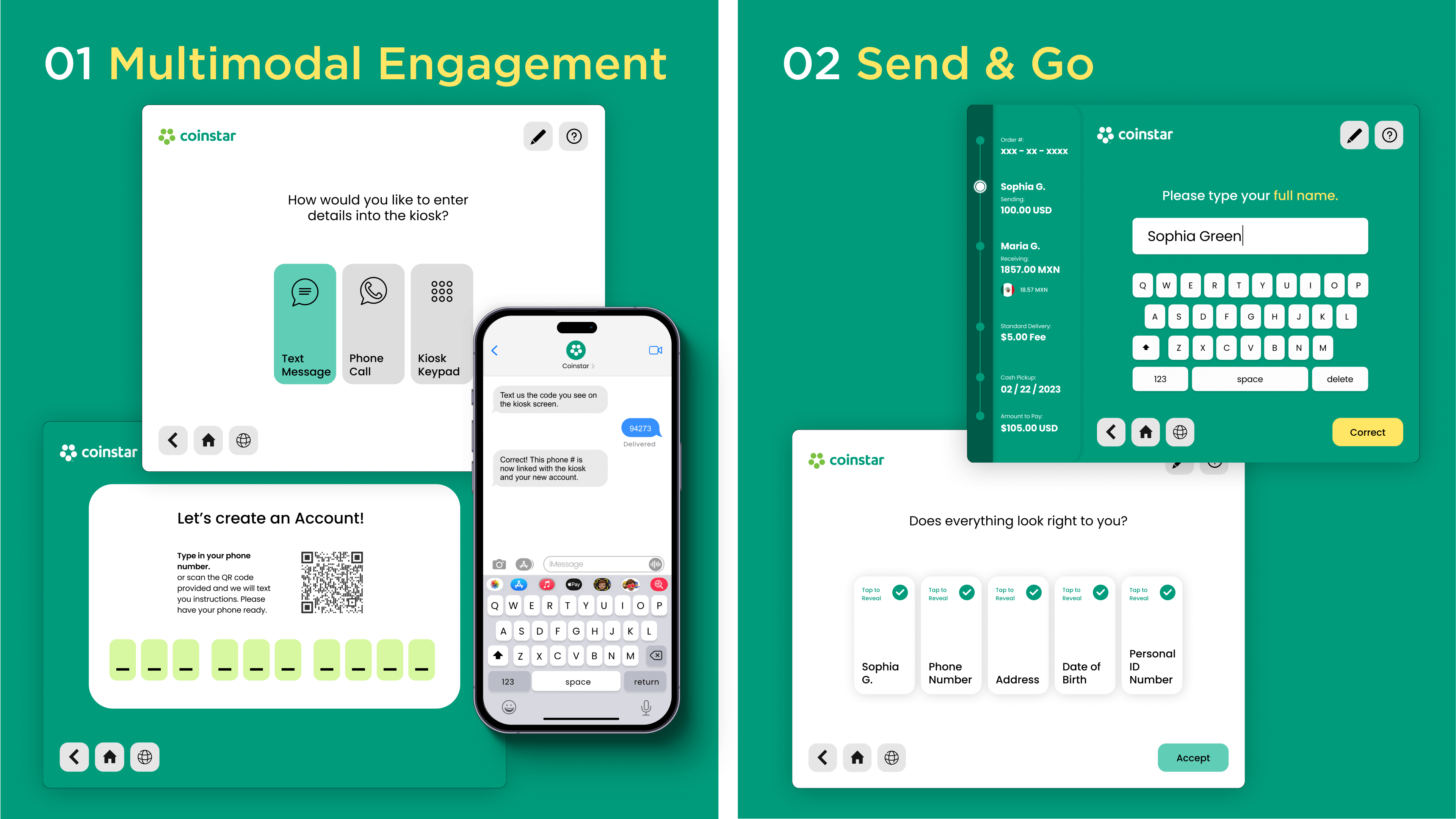

0A ● CONTROL INPUTS

This multimodal input system through SMS or web app permits customers to securely access their private account and pending transactions anywhere, anytime; not to mention touchless QR code access points to minimize touching surfaces.

Device research grew out of my curiosity to explore the community impact on tech interactions, leading me to confirm the cultural need for limited behavior changes.

0B ● SAFETY RECEIPTS

Senders prepare transactions and then receive automated and continuous notification receipts — expediting time and hidden fee anxiety.

When conducting analogous research, I noticed a rising trend of customers using messaging apps for service transactions. Hearing so much about the "money being sent" moment causing remittance users so much anxiety, I pivoted the app's platform to center around a messaging feature; the platform most importantly automates text receipts to sender and receiver at every stage of the remittance process.

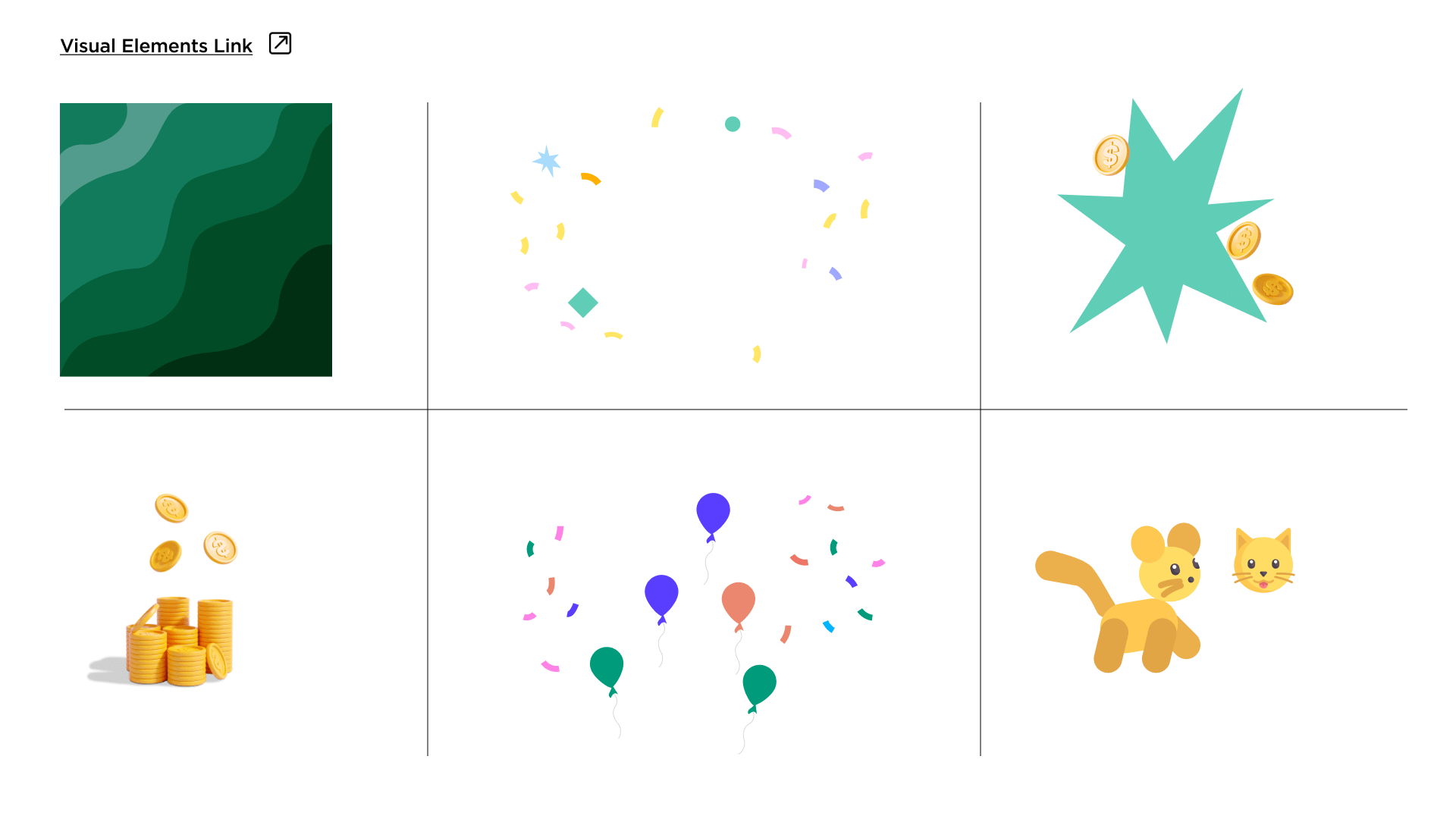

0C ● DELIGHTFUL MOTIVATION

To stimulate organic engagement, the service builds on the platform legacy services, leveraging the inherit trust already built and sensory design of reward features that provide delightful interactions and personalized data.

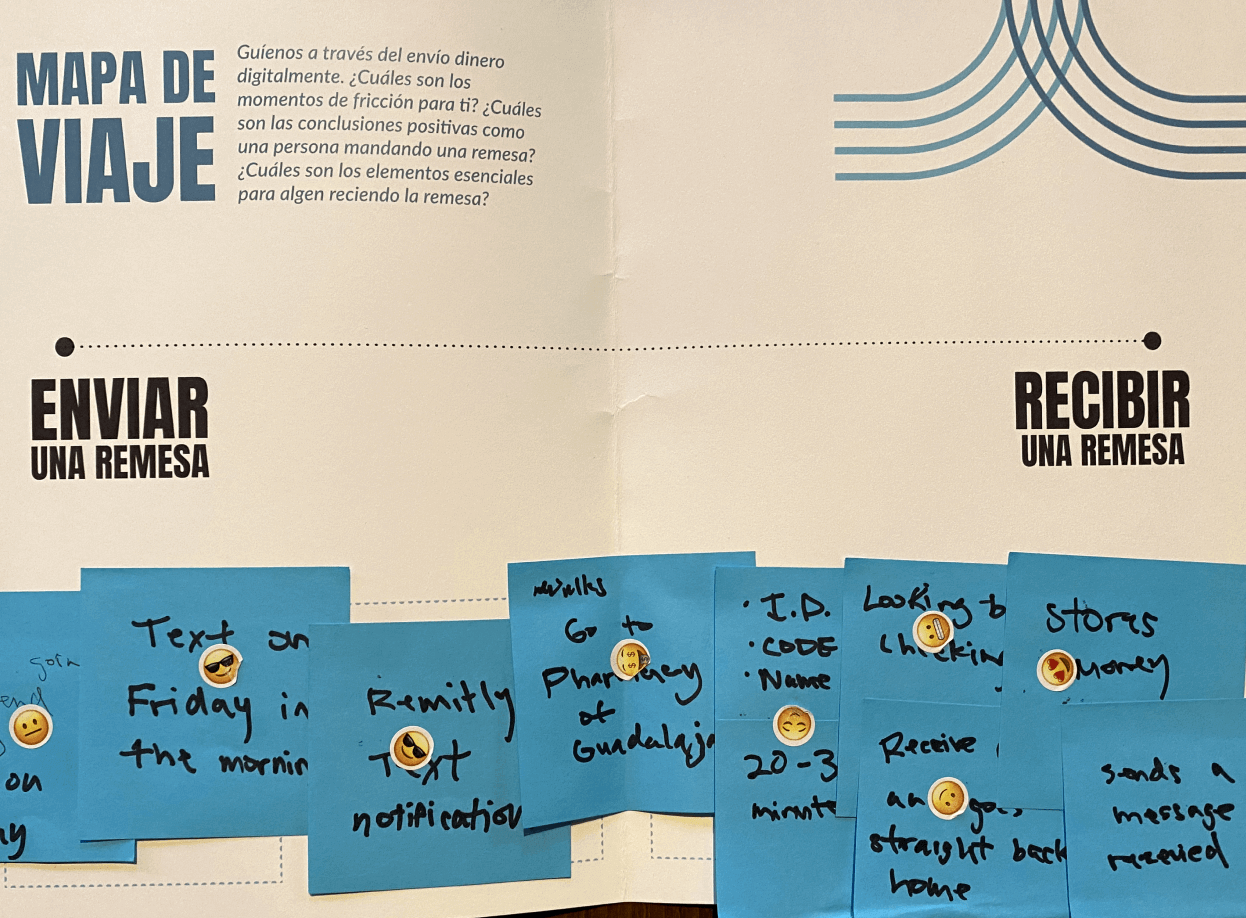

04 ▼ Research Phase

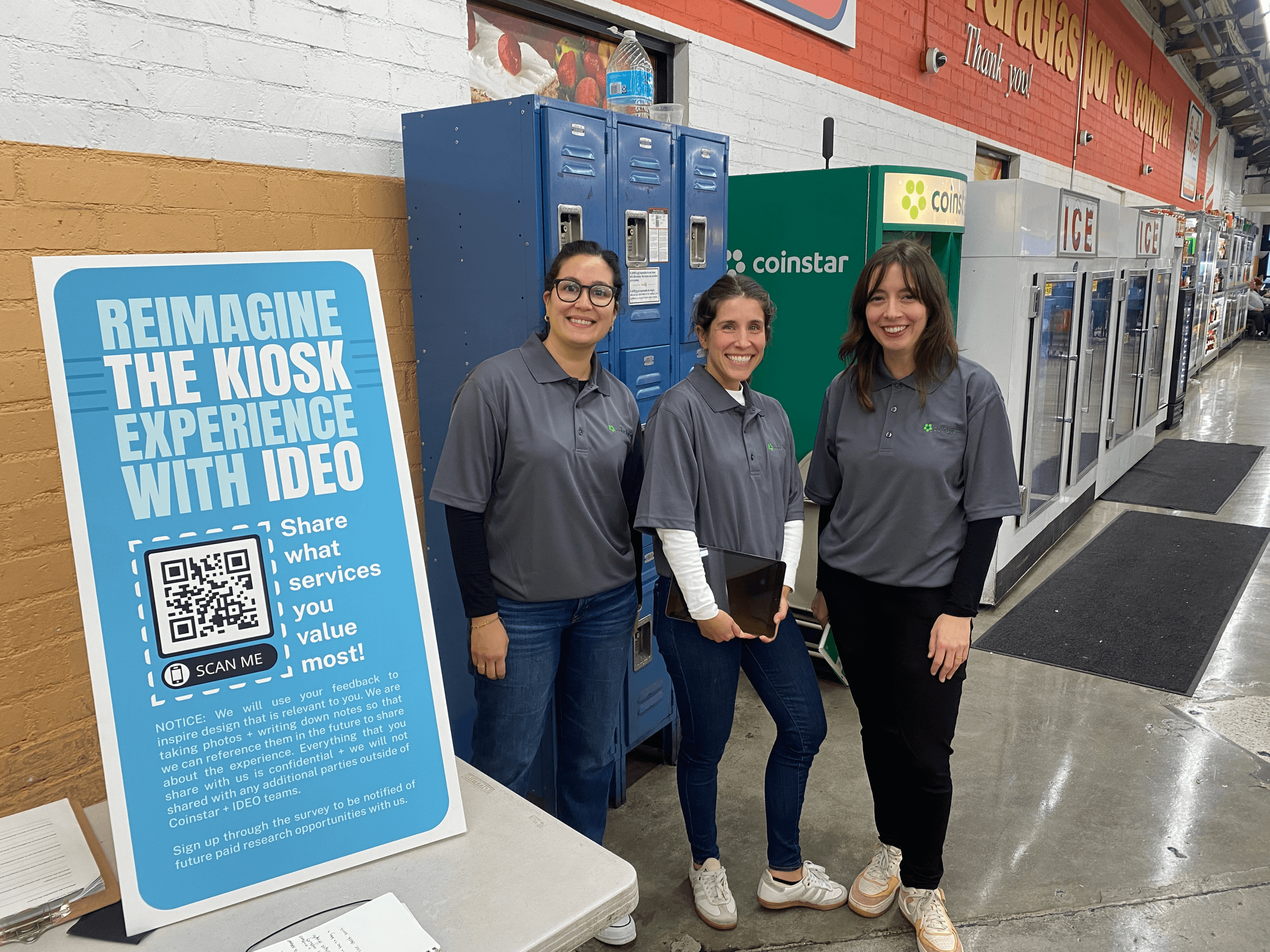

In addition to leading design, my role was to blend my teams’ focus on socio-economic inclusivity with the client’s desire to be an instant market leader into a cohesive product experience. Through multiple rounds of immersive, qualitative research, I exposed the right formula that enables a perfect market fit.

To unpack the cultural motivations and limitations of senders and receivers with such diversity of thought, I took the lead on promoting neutral observation; especially with such a broad range of opposing perspectives. The honest account of stressful failures and heartful wins helped the client's focus move beyond rapid financial gains to long term, social value, fundamentally changing how they perceived their customer.

05 ► Design Playbook

Design exercises strategically scattered throughout the development process to propel new thought and playful mindsets to reimagine the kiosk as a calm space with remittance as a gift giving service.

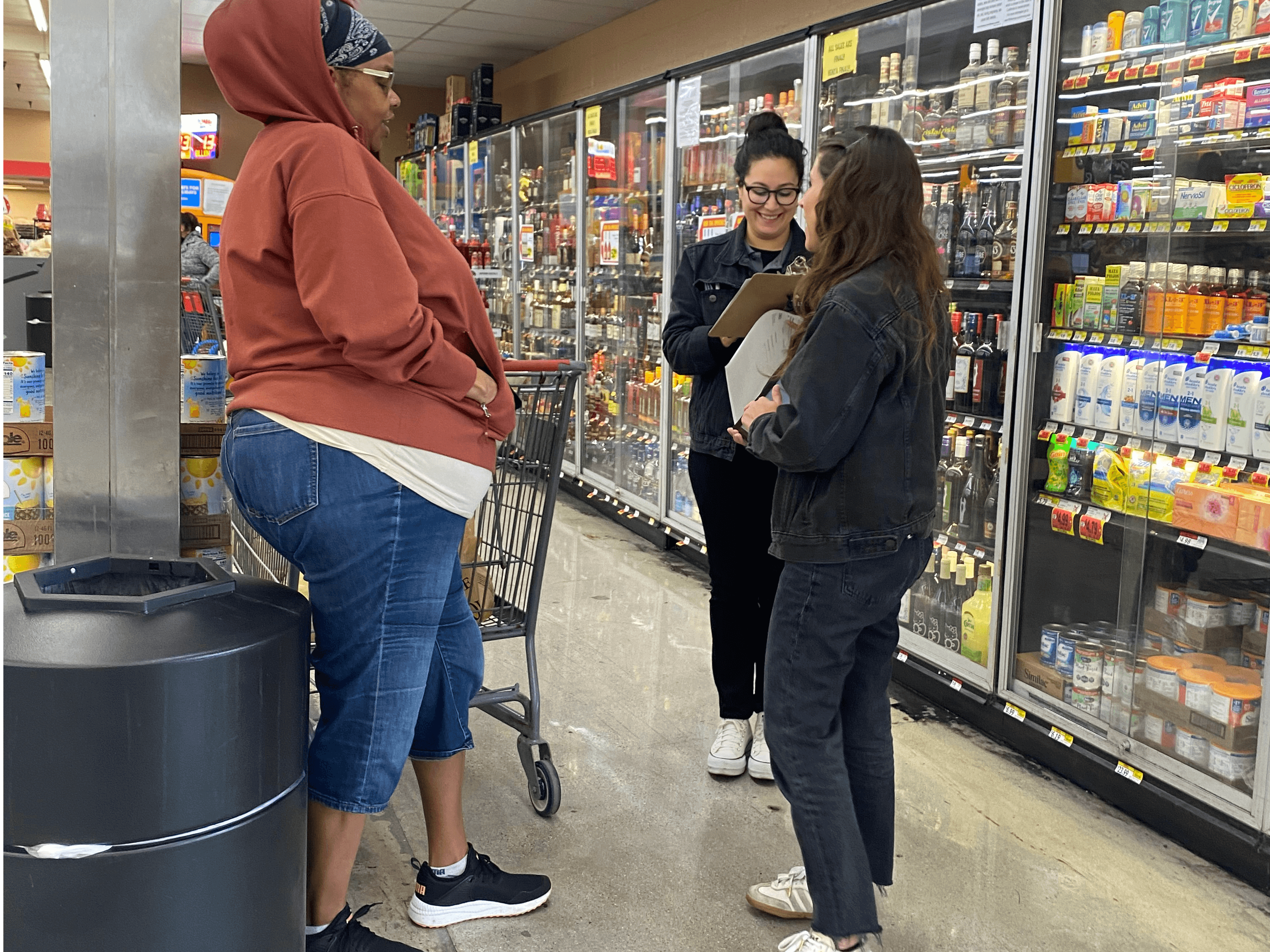

0A ● INTERVENING IN-CONTEXT

Leveraging the client's existing kiosk, I designed bilingual in-context interventions that required automation protocols to easily translate the updates with each iteration and design change.

Initially intended to test users' comfort with biomimicry & two-step authentication, I pivoted the intercept once it became clear that habitual comfort was the #1 driver and began to test multimodal “remotes” exploring tech competence & ease of use.

0B-1 ● HANDS-ON ITERATION

Personally designed strategic interventions during development to challenge thinking and approaches:

+ Analogous flows — integrate the competitive landscape research into the user flows, providing side by side examples of ways to push more robust thinking without jeopardizing the rapid prototyping sprints.

+ Re-enactment scripts — recreate key moments and auxiliary ideas from user interviews to introduce new perspectives and shift thinking; discoveries lead to pivoting features and the final pitch to the client.

0B-2 ● MOODJAMS

To successfully transition between the moments of calm, safety, and delight, I designed multi-sensory brainstorms to unpack the right mood, sound, and UI elements with my team.

0C ● TESTING 1 ON 1

To fundamentally redesign how the market thinks of remittance, centralized around the delight of giving, I built a large-scale kiosk model in the studio to test ideas in an immersive, IRL environment; in turn, accelerating rapid prototyping.